Might 2017 marks the one-yr anniversary of the implementation by the U.S. Securities and Change Fee of Regulation CF crowdfunding for non-accredited buyers. Some observers consider it’s a catastrophe whereas others assume it has been a modest success. Virtually everybody agrees it must be modified to be efficient in offering capital to startups and small companies. Final yr, in truth, the “Repair Crowdfunding Act” was handed within the U.S. Home of Representatives however not the Senate. It should possible come up once more in 2017.

Crowdfunding Historical past

Within the JOBS Act of 2012, Congress accepted crowdfunding investments by non-accredited buyers — these with belongings beneath $1 million or annual earnings of lower than $200,000. The S.E.C. didn’t finalize laws till February 2016 and the primary portals have been permitted shortly thereafter — funds could be raised solely by way of permitted on-line portals and the utmost that an organization can increase from non-accredited buyers is $1 million a yr. As of April 2017, there have been 26 authorised portals however not all of them have executed profitable raises.

The JOBS Act additionally made modifications to the principles governing corporations looking for accredited investor funding. For the primary time, corporations might be intermediaries for accredited buyers and a number of other portals have efficiently helped begin-ups and present companies increase capital. A few of these portals at the moment are including Regulation CF crowdfunding — “CF crowdfunding” — to their choices, serving each accredited and non-accredited buyers.

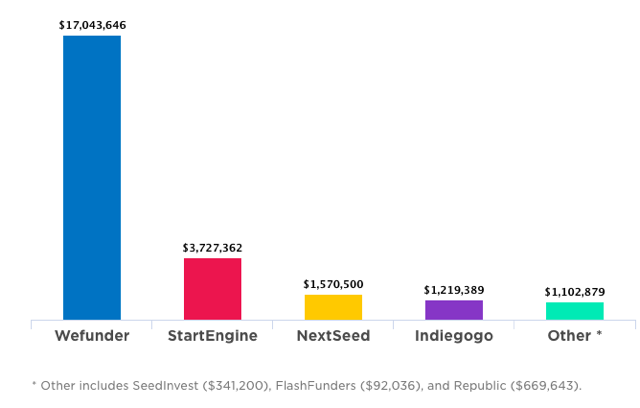

Quantity raised with CF crowdfunding by portal. Supply: Wefunder.

Present State of affairs

Between Might sixteen, 2016 and April 27, 2017, 29,623 people invested in 88 profitable Regulation CF choices value $24.7 million, based on CF portal Wefunder, which reported that it accounted for sixty nine % of the funding and sixty seven % of the choices. Three corporations raised the utmost $1 million allowed, all on Wefunder.

The highest 5 classes for all Regulation CF fundings are as follows.

- Know-how: $eight.9 million.

- Meals: $6.6 million.

- Alcohol: $6 million.

- Hardware: $four.7 million.

- Software: $three.9 million.

Wefunder has been extra profitable than different portals as a result of it was a pioneer in encouraging companies to make use of fundraising mechanisms aside from straight fairness. Corporations elevating cash on Wefunder supply income sharing, loans (relatively than fairness), and convertible notes that pay curiosity after which convert to fairness at a later date. Debt CF fundraising has confirmed to be extra well-liked than fairness crowdfunding as a result of fairness is usually illiquid. One portal, NextSeed, gives debt crowdfunding solely.

Most Regulation CF crowdfunding portals at the moment are providing a SAFE — Easy Settlement for Future Fairness — that provide buyers the best to discounted shares at a future date. The variety of shares is decided on the subsequent certified fairness financing (comparable to enterprise capital) and the conversion worth per share is predicated on the worth per share in that certified financing.

Wefunder costs six % of a profitable increase. StartEngine, the second most profitable Regulation CF portal, takes a 5 % payment for a profitable marketing campaign, whereas NextSeed takes 10 %.

Just like Rewards-based mostly

An fascinating facet of CF crowdfunding is the incorporation of most of the options of rewards-based mostly crowdfunding websites, akin to Kickstarter and Indiegogo. Movies, perks, social media sharing, and a feedback part for potential buyers all mirror campaigns on reward-based mostly portals. These are along with all of the monetary and different filings required by the S.E.C. This meshing of the 2 fashions is now the usual for CF crowdfunding.

A number of of the profitable CF crowdfunding corporations initially raised funds on both Kickstarter or Indiegogo, establishing a monitor report of fundraising and securing an inventory of potential buyers.

Indiegogo only recently entered into an association with MicroVentures, an authorised portal, to supply CF crowdfunding. Kickstarter has said that it isn’t enthusiastic about CF crowdfunding.

Various Funding

The 4-yr wait between the passage of the laws and the implementation of Regulation CF meant that many entrepreneurs which may have raised cash from unaccredited buyers sought funding from accredited buyers as an alternative. Reg D, enacted by the S.E.C. as a part of the JOBS Act quickly after the laws was handed, is especially engaging due to the much less rigorous laws.

Regulation D permits an organization to solicit and usually promote an providing, however the firm continues to be deemed to be enterprise a personal providing and doesn’t need to register it with the S.E.C. Many CF portals began providing Reg D fundraising when it turned clear that CF fundraising can be delayed for years.

Enhancing Regulation CF

The next modifications would enormously enhance CF crowdfunding — benefitting each small companies trying to develop and small buyers looking for monetary good points.

- Improve the $1 million cap. Virtually everybody agrees that the cap must be elevated to no less than $5 million.

- Scale back the disclosure necessities. CF crowdfunding includes a variety of paperwork, principally associated to monetary disclosures. Authorized and accounting charges might be substantial, particularly for corporations making an attempt to boost over $500,000 as a result of the disclosures are extra detailed. Disclosures can value as much as 20 % of the increase. Decreasing the disclosure necessities for raises over $500,000 would encourage extra entrepreneurs to think about CF crowdfunding, particularly if finished together with growing the $1 million restrict.

- Create a secondary marketplace for shares. CF crowdfunding fairness investments are illiquid — buyers can’t promote shares till an organization goes public or is acquired.