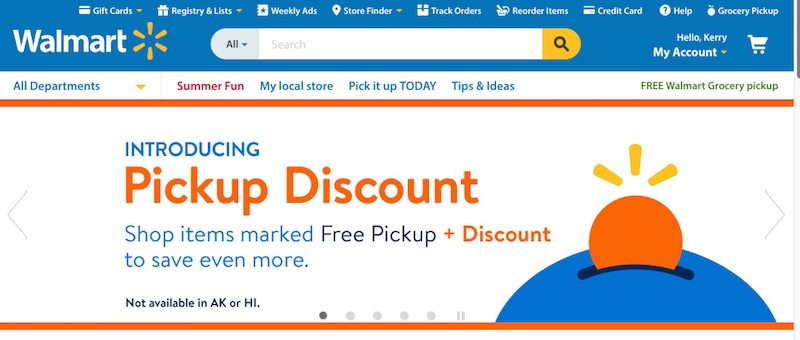

Walmart is spending closely to reinforce its ecommerce capabilities. This consists of buying progressive ecommerce retailers and investing in know-how infrastructure. Walmart’s “Pickup Low cost,” proven above, rewards clients who purchase on-line and decide up at an area Walmart retailer.

After an ecommerce energy-up that included buying a string of on-line retailers, together with Jet.com, Walmart took a serious swing at Amazon by providing free 2-day delivery for certified orders of $35 or extra, no particular membership required. Amazon was fast to reply by decreasing its free 2-day delivery threshold to $25 for non-Prime members and providing forty five % off Prime membership for low-revenue consumers.

The competitors is heating up, however which firm will win?

Let’s take a look at the numbers.

Amazon has a present market cap of $477 billion and $21.5 billion of money available. Its 2016 income was $136 billion. Via innovation, sensible enterprise techniques, and sheer brute pressure it has been capable of develop yr after yr and dominate American ecommerce. Buyers and analysts appear to be betting on Amazon, pushing its share worth previous $1,000 for the primary time in Might.

Walmart, nevertheless, can’t be simply dismissed. Regardless of the monetary and tech sector hype surrounding Amazon, Walmart is a juggernaut with a market cap of $236 billion and a bodily retailer presence inside 10 miles of ninety % of all People. Its complete income for 2016 was $482 billion, and with Jet.com founder Marc Lore on the helm, Walmart’s ecommerce gross sales for the quarter ended April 30, 2017 grew by an a powerful sixty three %.

Walmart is subsequently in a singular place to make giant strikes towards Amazon. It has each the deep pockets and widespread worthwhile bodily retailer presence to take action.

However my guess is that neither firm will obtain true dominance. As an alternative, their conflict will probably be lengthy and brutal, inflicting big disruption in retail.

Actions from Walmart

Let’s think about a few of the actions Walmart may take towards Amazon.

1. Assault free delivery. Walmart is providing reductions to clients who’re prepared to select up their orders at Walmart places. Moreover, it’s taking the unprecedented step of enlisting its personal retailer staff to drop packages off on their means house from work. These strikes assist mitigate the excessive prices of final mile supply for Walmart and will permit it to once more drop its free 2-day supply threshold under Amazon’s present $25.

These steps hit at Amazon’s biggest weak spot as an internet retailer: its lack of a widespread bodily presence. Along with decreasing costs and decreasing 2-day delivery thresholds, Amazon will possible need to proceed increasing the variety of its distribution facilities, pickup places, and bodily shops — this might be the logic behind its current $thirteen.7 billion acquisition of Entire Meals Market.

2. Problem different Prime advantages. With forty nine million members spending twice as a lot as non-members, Prime is a serious money cow for Amazon. Prime isn’t nearly retail nevertheless. This system provides a slew of different perks, together with free films, tv exhibits, books, magazines, and music streaming. Walmart might have to supply its personal model of Prime to attract these members away from Amazon.

Walmart would subsequently be sensible to companion with Netflix, Hulu, or HBO to supply comparable leisure perks by way of a revamped membership program. It might develop a less expensive program with sufficient further options to entice members away from Prime.

three. Deflect Amazon’s strikes into prescription drugs. Business observers have been predicting Amazon strikes into prescription drugs for some time. The healthcare business accounts for almost 18 % of U.S. gross home product. Prescription drugs can be a logical subsequent step for the ecommerce big.

To deflect this, Walmart might aggressively push its pharmaceutical weight round. It’s the fourth largest U.S. pharmacy by complete income, with hundreds of pharmacies throughout the U.S. Ought to it start providing deeper reductions on generic medicine and ramping up its on-line prescription providers to incorporate similar day supply, Walmart might make it troublesome for Amazon to get traction on this business.

four. Transfer into tech. Within the final yr, Walmart has acquired Jet.com, Hayneedle.com (residence decor), Footwear.com, Moosejaw (brick-and-click on retailer of outside recreation gear), and Modcloth.com (ladies’s attire).

As Walmart’s ecommerce portfolio expands, it should want computing infrastructure just like Amazon’s that’s automated and standardized amongst all of its retail companies — primarily turning Walmart into an enormous tech firm. Walmart C.E.O. Doug McMillon acknowledged this actuality when he lately said, “Speedy advances in know-how imply we have to develop into extra of a digital enterprise, and that’s what we’re doing.”

Constructing such infrastructure would additionally present Walmart with one other angle to assault Amazon. Like Amazon Net Providers, Walmart might lease out its cloud computing belongings, utilizing the income to pay for the funding and, additionally, subsidize its retail enterprise.

Different Retailers and Manufacturers

The excellent news for the remainder of the business is that Walmart and Amazon’s battle for market share will create alternatives for different retailers and types.

Investments made by these business titans will possible result in up to date know-how, the event of extremely environment friendly provide chains, and a pool of professional expertise accustomed to all of it. Smaller corporations will reap the fruits of such improvements.

Moreover, decrease costs and delivery thresholds will spur the expansion of ecommerce as extra shoppers reap the benefits of these financial savings. For instance, Amazon’s current seize for Walmart’s low-revenue clients might introduce a brand new demographic to on-line purchasing. That is good for different ecommerce corporations.

Briefly, the 2 teams of winners on this conflict of titans can be these manufacturers and retailers that benefit from the alternatives, and ecommerce shoppers, who will reap the fee and timesaving advantages.