Google has banned payday loan PPC ads, but who benefits?

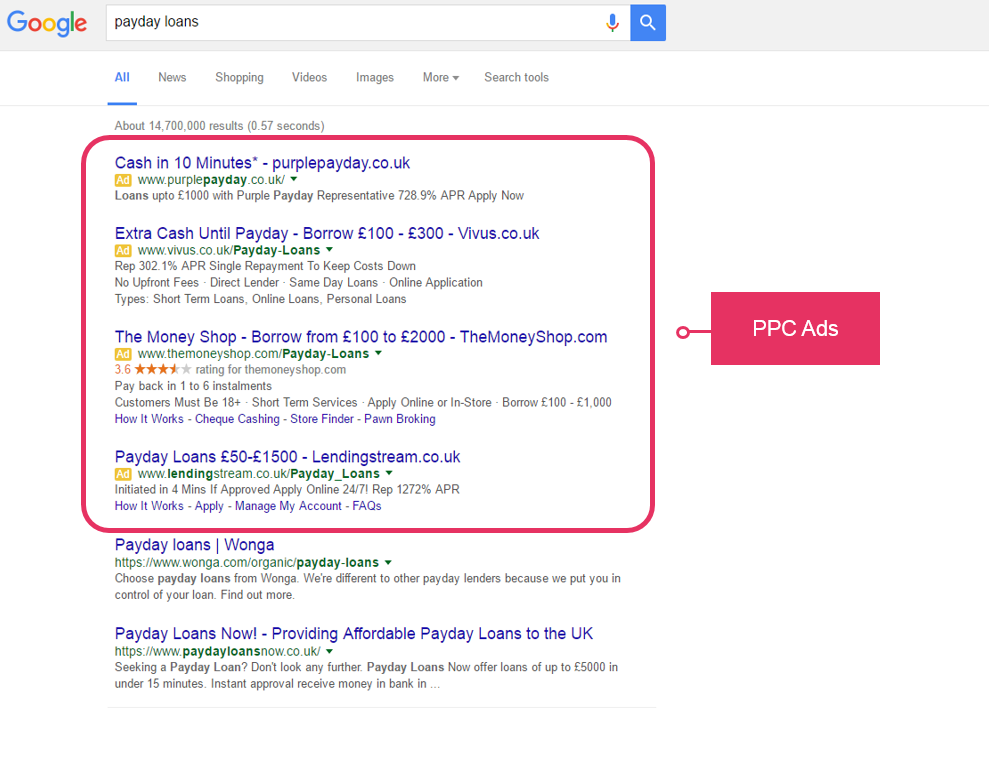

Last week, Google introduced a change to its AdWords coverage round payday loans, banning advertisements for merchandise with excessive APRs and brief reimbursement phrases.

I’ve been speaking to a payday mortgage supplier, and we’ll additionally take a look at this choice from Google, made seemingly for ethical causes.

According to Google:

“Today we’re sharing an replace that may go into impact on July thirteen, 2016: we’re banning advertisements for payday loans and a few associated merchandise from our advertisements techniques. We will not permit advertisements for loans the place reimbursement is due inside 60 days of the date of challenge.

In the D.R., we’re additionally banning advertisements for loans with an APR of 36% or larger. When reviewing our insurance policies, analysis has proven that these loans may end up in unaffordable cost and excessive default charges for customers so we can be updating our insurance policies globally to mirror that.”

So has Google accomplished this for ethical causes?

Well, payday loans can definitely be dangerous merchandise. Most quote one thing like seven hundred% APR or above. It will sometimes value within the area of £ninety to borrow £200 for 3 months. This is steep, however the long run loans provided by such websites are worse, whereas late or missed cost charges may be extortionate.

This transfer won’t essentially cease payday loans corporations bidding on the time period, however they are going to be restricted on the varieties of product they will promote.

The apparent impact is that this removes a quick path to marketplace for newer payday mortgage companies who typically supply even worse phrases than the extra properly-know manufacturers. If they will’t pay for PPC, they’ll have to work on an extended-time period web optimization technique to realize any visibility on Google.

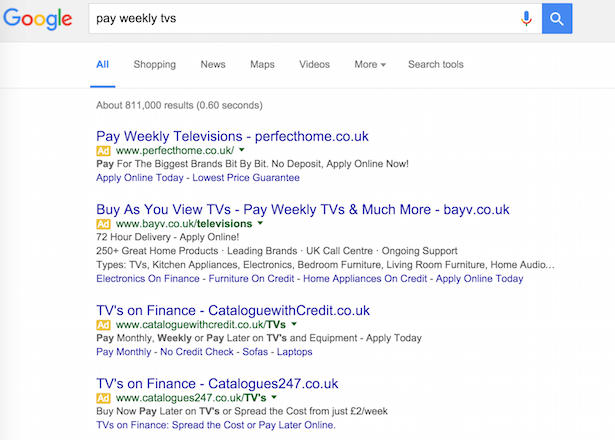

However, Google nonetheless permits different merchandise which might be dangerous. For instance, there are many advertisements for residence electronics which might be paid in instalments, at some very unfavourable phrases.

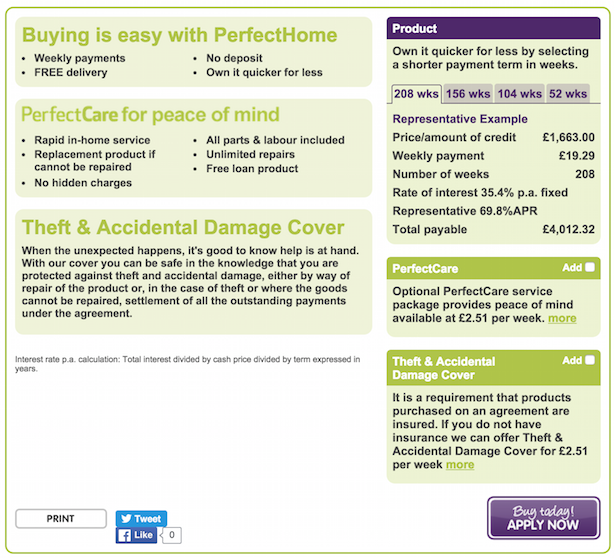

For instance, one of many advertisements above results in this LG TV, which may be purchased for round £M,600 on a number of websites.

However, with the curiosity right here, clients will find yourself paying again greater than £A,500 (the obligatory insurance coverage provides one other £522 to the fee). This might be simply as damaging as a payday mortgage.

Of course, we even have classes comparable to playing. Indeed, playing phrases make up seventy seven of the highest one hundred PPC key phrases within the UK. Gambling can destroy.

So, it’s an fascinating one. Google has chosen to take an ethical stand on payday loans, however there are lots of different authorized however probably dangerous merchandise or industries which haven’t any restrictions.

A win for Wonga?

The most blatant impact is that, by eradicating PPC advertisements for such merchandise, this advantages the established gamers out there, Wonga et al.

No PPC advertisements signifies that newer entrants to the market not have a fast path to the highest of the SERPs, and can discover it onerous to beat the natural dominance of the established gamers.

As Will Critchlow places it:

How many corporations would leap at a deal that meant that neither they *nor their rivals* might purchase search advertisements? https://t.co/ZRZ0xPqjgf

— Will Critchlow (@willcritchlow) May 12, 2016

Jonathan Beeston echoes this view:

Searchers will nonetheless have the ability to discover payday loans companies via the Organic outcomes. For robust manufacturers listed in a excessive place, this coverage change could be useful. Competitors and new entrants gained’t have the ability to purchase their method to the highest.

Data from SimilarWeb suggests Wonga.com will get 37.H% of its desktop visitors from search, however ninety nine.B% of that’s natural. At worst this modification can be impartial for Wonga, and fairly probably they’ll do nicely out of it.

The stats again this argument up. According to knowledge from PI Datametrics, the most effective performing websites by search engine marketing visibility are Wonga and the extra recognisable manufacturers within the sector.

Those paying for PPC advertisements in the intervening time appear to be those with much less natural visibility, none of these listed within the chart above.

For instance, the location with the second PPC advert has little or no natural footprint.

So, to reply the query, it seems like a win for Wonga and comparable lenders. Though, as Jonathan Beeston identified, it might additionally assist fintech startups:

The different winners from this variation perhaps Fintech startups. Plenty of corporations try to disrupt the poor credit score lending area, reminiscent of Lendup and Lending Club. It’s value noting Lendup has taken funding from Google Ventures. Lending Club acquired cash from Google itself. I’ll let the conspiracy theorists take it from right here.

The payday lender’s view

I requested Luke Enock, Director of Online at Satsuma Loans, about Google’s choice.

“We welcome Google’s announcement. It marks an necessary watershed for the non-normal shopper lending market because it makes a transparent distinction between properly-regulated on-line credit score suppliers like Satsuma, with its stringent affordability checks, clear pricing and no hidden additional costs on the one hand, and fewer buyer-targeted payday lenders on the opposite.”

Presumably this now advantages these lenders with a greater natural search technique, in addition to saving on PPC spend?

“Google aren’t taking these corporations out of the SERPs from natural so I can nonetheless see these companies working within the brief time period. Unless Google launches a brand new algorithm replace that targets these corporations and removes them from the SERPs as nicely, however I can’t see this occurring any time quickly. Organic and paid groups actually converse to one another.

There is a necessity for corporations like Satsuma Loans to function, about one in seven individuals within the UK can’t get loans from banks, so until Google is all of a sudden enjoying God and saying that these individuals abruptly can’t have any credit score to assist when an sudden invoice arrives, then they need to nonetheless permit respected corporations to bid.

Non payday mortgage corporations I am assuming will nonetheless have the ability to bid on the phrases – Google haven’t stated they gained’t settle for bid for the time period, simply payday mortgage corporations gained’t be permit to bid them on their community.

So for us PPC will nonetheless be a key channel, however simply means a few of the individuals we’re bidding towards drop out – however others will are available.”

In abstract

Whatever the rationale for Google’s choice, plainly this transfer will serve to additional set up the extra recognisable lenders on this sector. As these usually tend to be regulated than newer entrants, this does have some advantages for shoppers.

It additionally underlines the significance of web optimization in aggressive markets like this. While PPC has provided a quicker route to look visibility for a lot of, these manufacturers which have seemed longer-time period and put an web optimization technique in place look set to profit right here.