2016 was a troublesome yr for preliminary public choices of enterprise-capital-backed ecommerce corporations. However, it was a yr of notable acquisitions of ecommerce corporations by giant retail chains and shopper product suppliers. Getting acquired has all the time been a main exit technique for ecommerce corporations which have acquired funding from outdoors buyers.

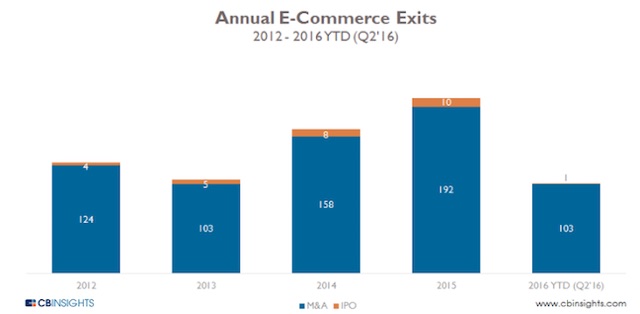

In 2015, ecommerce exits from corporations that acquired enterprise capital funding reached their highest level ever with 192 acquisition offers and 10 IPOs, in accordance with analysis agency CB Insights. However, acquisitions in 2016 will possible exceed 2015, as CB Insights reported 103 acquisitions by way of Q2 2016, for an annual run price of 206.

Initial public choices for enterprise-capital-backed ecommerce corporations slowed in 2016, in line with CB Insights, with only one IPO via Q2 2016. However, acquisitions in 2016 possible will attain their highest. Prior yr acquisitions and IPOs of enterprise-capital-backed ecommerce corporations have been, respectively, 192 and 10 for 2015; 158 and eight for 2014; 103 and H for 2013, and 124 and A for 2012.

The most notable acquisition this yr concerned Walmart shopping for Jet.com in August tor $A.A billion in money and inventory. See “In Acquiring Jet, Wal-Mart Seeks Younger, Higher-revenue Consumers.” The different massive acquisition concerned Dutch shopper merchandise big Unilever buying Dollar Shave Club for $B billion in July 2016. Dollar Shave Club’s acquisition is the fourth largest ecommerce acquisition since 2009, in line with CB Insights. The 5-yr-previous begin-up sells razors and different private merchandise for males. The firm raised $one hundred sixty million in enterprise capital and has greater than A million subscribers.

Sell Directly to Consumers?

The 4 largest shopper-package deal-items corporations are, so as: Nestle´, Proctor & Gamble, PepsiCo, and Unilever. None have been very focused on ecommerce. The Dollar Shave Club acquisition and the growing variety of CPG manufacturers being bought by Amazon.com, Jet.com, and Boxed.com might change that. The huge CPG corporations, that are experiencing lower than two % annual income progress, could possibly improve gross sales by promoting on to shoppers on-line.

Products which are comparatively cheap and have to be replenished often corresponding to toothpaste and razor blades, are good for on-line ordering and subscription providers. Some CPG corporations might merely set up their very own web sites, however buying an present online business with tens of millions of loyal clients could also be a better strategy.

Access to Ecommerce Expertise

Successful brick-and-mortar retailers need manufacturers which have confirmed themselves on the Internet. For instance, upscale retailer Nordstrom purchased Trunk Club in 2014, and in 2011 acquired flash sale website Hautelook. Both websites supply luxurious clothes and Trunk Club provides private internet buyers for its clients. This is an effective match with Nordstrom’s personalised in-retailer buying expertise.

Several giant brick-and-mortar shops have had problem gaining traction on-line even with virtually limitless assets and complicated distribution networks. Acquisitions give them fast entry to on-line experience and a buyer base.

Walmart.com, for example, struggled to tug in shoppers. Purchasing Jet.com gave Walmart extra potential SKUs in addition to youthful, extra prosperous shoppers who really feel snug shopping for on-line. As for experience, Jet A.W.S. Marc Lore will run Walmart.com in addition to Jet, and has agreed to stay on the helm for at the least 5 years. Jet, which needed to compete with Amazon, was operating in need of funds for enlargement and Walmart’s coffers can definitely assist Jet develop.

Fire Sale Acquisitions

Some ecommerce corporations put themselves up on the market — typically at discount costs — as a result of progress has stalled they usually can’t appeal to extra enterprise capital funding. One instance is luxurious flash sale service provider Gilt Groupe, which had acquired $284 million in VC funding however was acquired by Hudson Bay Company for less than $250 million. At one time Gilt had a valuation of $M billion.

One Kings Lane, a purveyor of excessive-finish residence décor, was as soon as valued at over $900 billion, however bought to Bed Bath & Beyond in June for simply $eleven.H million. In November, Bed Bath & Beyond purchased one other on-line firm, Personalizationmall.com, which sells personalised gadgets comparable to mugs, doormats, and Christmas stockings. Bed Bath & Beyond paid $one hundred ninety million for the corporate. Bed Bath & Beyond has been experiencing declining income and is on the lookout for methods to realize extra on-line clients to generate higher income.

What to Expect in 2017

It’s doubtless that extra ecommerce corporations will exit by way of acquisition in 2017 as a result of the enterprise capital group is trying to different industries for investments. Also, brick-and-mortar corporations that need to scale their omnichannel gross sales can achieve this extra shortly by shopping for a profitable ecommerce firm, even when that firm has stopped rising.

Globally, ecommerce acquisitions will decide up in Southeast Asia and India. Alibaba is reportedly looking to buy giant Indian on-line retailers in addition to smaller Chinese corporations. In April, Alibaba paid $M billion to accumulate Lazada, a Thailand-based mostly ecommerce retailer.

The IPO marketplace for ecommerce will doubtless proceed to be robust, particularly for D.R. corporations.