The D.R. Securities and Exchange Commission just lately carried out laws that permit corporations to solicit non-accredited buyers within the D.J. for fairness investments. This stems from the JOBS Act, which was enacted in 2012. Wefunder, proven above, is one in every of a number of on-line fairness crowdfunding platforms.

It took 4 years after President Obama signed the JOBS Act, however the D.R. Securities and Exchange Commission lastly permits companies to solicit people who find themselves not thought-about rich to spend money on new corporations by way of on-line fairness crowdfunding. Effective May 15, companies can promote funding alternatives to non-accredited buyers by way of on-line portals.

How It Works

Individual buyers should register on every portal and certify that they meet the necessities and perceive the dangers. They can browse the record of corporations which are soliciting buyers and skim the marketing strategy and financials. If they determine to take a position, they will achieve this on-line. Those with an revenue of lower than $one hundred,000 per yr are allowed to take a position the larger of $P,000 or 5 % of their revenue yearly. Individuals with an revenue of greater than $one hundred,000 can make investments as much as 10 % of revenue, with a most funding of $one hundred,000. Investments may be unfold over a number of corporations.

Many of the portals additionally supply accredited investor alternatives on the identical website. Non-accredited people who need to make investments ought to subsequently search for the letters “CF” (“Regulation Crowdfunding”) or “Title III” subsequent to description and keep away from “Reg A” and “Reg A” labels, which apply to accredited buyers.

Portals

Crowdfunding portals should submit an software to the Securities and Exchange Commission and grow to be a member of the Financial Industry Regulatory Authority. Thus far, the FINRA has accredited 12 portals, however not all have beginning taking investments. Portals which might be accepting investments embrace the next.

- SeedInvest

- StartEngine

- NextSeed

- CrowdBoarders

- Jumpstartmicro

- truCrowd

- Ufundingportal

- Wefunder

Some portals require that a person register both as an entrepreneur or an investor to see funding alternatives. Others permit for public shopping.

A few portals intend to focus on area of interest markets solely. For occasion, Indie Crowd Funder shall be elevating funds for the leisure business. Niche market, rewards-based mostly crowdfunding platforms discovered it arduous to compete with the bigger websites reminiscent of Kickstarter and Indiegogo and ultimately went away. That might occur within the fairness crowdfunding area as nicely.

Was It Worth the Wait?

With solely a two-month monitor report, it’s arduous to say whether or not the brand new CF guidelines are working. There are few corporations utilizing the principles proper now. Wefunder estimates that since fairness crowdfunding started two months in the past, about 36 corporations try to boost about $A million by way of this various.

One obstacle is that solely $B million could be raised in a yr by way of non-accredited buyers. So corporations that want extra are looking for funding from accredited buyers by way of portals, a system that has been in place for a number of years. Also, administrative prices associated to the increase could be excessive — as much as 20 %.

Some corporations could also be ready to see if the CF mannequin might be profitable. Also no one is promoting this feature to most of the people and the schooling course of might take a while.

What’s Working?

Companies, not the portals, determine how one can construction their choices. While some campaigns are usually not gaining a lot traction, corporations on one portal, Wefunder, are having profitable raises. The means they’re succeeding is sort of fascinating and should transform a mannequin for different portals.

For instance, shopper items corporations on Wefunder are operating campaigns that mirror rewards-based mostly crowdfunding. The campaigns embrace movies, updates, social media sharing, and rewards for investments. The minimal purchase-in is sort of low, often $one hundred.

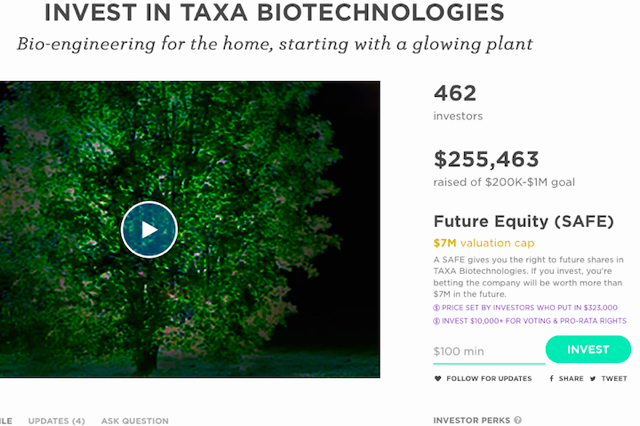

A few corporations elevating funds on Wefunder are providing a SAFE (easy settlement for future fairness) choice, which provides the businesses flexibility over when crowdfunding buyers develop into shareholders or house owners of document. This strategy eliminates maturity dates and accrued curiosity related to convertible notes however offers a hard and fast conversion worth to buyers. While the minimal funding is $one hundred, those that make investments a higher quantity get extra enter into how the enterprise is run.

A SAFE choice on Wefunder — similar to this one from TAXA Biotechnologies — provides corporations flexibility over when crowdfunding buyers turn out to be shareholders or house owners of document.

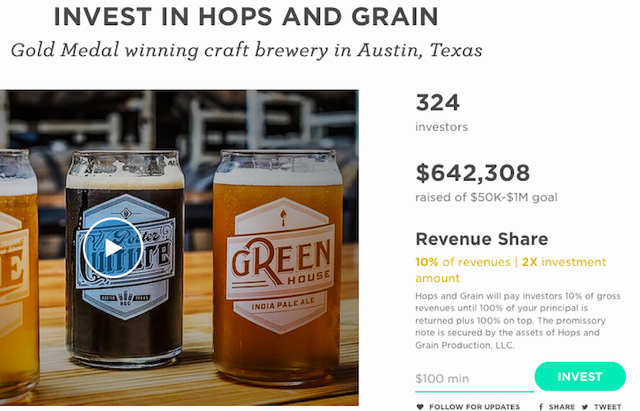

One of the primary issues with fairness crowdfunding is the shortage of liquidity of the investments as a result of there isn’t any dependable secondary marketplace for promoting shares, to money-out of investments. Two corporations elevating funds on Wefunder are getting round this by offering a income sharing mannequin. One of those corporations, Hops and Grains. intends to pay buyers 10 % of gross revenues till one hundred pc of the principal is returned, plus a further one hundred pc. The belongings of the enterprise safe the promissory observe. This choice, whereas pricey to the corporate, is extra interesting to potential buyers

Hops and Grains makes use of Wefunder to boost fairness capital. Hops and Grains intends to pay buyers 10 % of gross revenues till one hundred pc of the principal is returned, plus a further one hundred pc.

Conclusions

As with rewards-based mostly crowdfunding, preliminary fashions for CF investments might not work out. But the portals will probably discover an strategy that works for each buyers and companies. Rewards-based mostly crowdfunding big Indiegogo has indicated its curiosity in getting into the fairness market by the top of this yr and is exploring the way it may do this. Indiegogo’s visibility will in all probability appeal to extra entrepreneurs than new portals that don’t have a longtime status. CF fairness raises will subsequently not obtain actual traction till 2017, probably.