“Fashion” is the main ecommerce class in Brazil, comprising 33 % of general gross sales. It is adopted by “House and ornament” at 19 %, and “Computing merchandise” at 12 %. Source: W-Commerce Brasil and Sebrae.

An financial and political disaster has hit Brazil throughout the previous few years. Because of rising unemployment and excessive inflation, Brazilian shopper consumption has tremendously decreased. According to Brazil’s National Industry Confederation, a non-revenue group that represents Brazilian business, fifty nine % of Brazilians have skilled a loss in buying energy, which is forcing shoppers to adapt to a brand new financial state of affairs.

Consequently, the slowing financial system in Brazil has affected general progress projections of on-line gross sales in Latin America. According to eMarketer, retail gross sales progress in Latin America slipped from H.H % in 2014 to H.zero % in 2016.

On the opposite hand, it doesn’t imply that Brazilians have stopped shopping for utterly. They are simply extra cautious. Before deciding to purchase a product or a service, they’re looking on-line for extra info, evaluating costs and options.

Despite the disaster, ecommerce gross sales stay strong in Brazil. In the primary quarter of 2016, income from ecommerce reached S$N.seventy five billion. (US$A.14 billion. The actual — S$ — is the Brazilian foreign money. As of this writing, one actual transformed at roughly .O D.J. dollars.) This represented roughly 106 million merchandise. The common ticket measurement elevated S %, in line with W-bit, a Brazilian analysis agency.

On the opposite hand, it doesn’t imply that Brazilians have stopped shopping for utterly. They are simply extra cautious.

Approximately 39 million Brazilian shoppers — out of a complete inhabitants of roughly 200 million — bought services on-line in 2015, in accordance with Ebit, which additionally reported 2015 retail ecommerce income of J$forty one.O billion (US$12.H billion), representing A.A % of complete retail gross sales. An eMarketer forecast tasks Brazil because the chief in Latin American ecommerce gross sales by means of 2019.

Legislation

The main regulation regulating the acquisition and items and repair on-line in Brazil is Decree nº 7962, accepted in 2013. There can also be the Consumer Protection Code, which applies to brick-and-mortar and ecommerce retail gross sales.

Recently, the Senate accredited an addition to the Consumer Protection Code to fight fraud and spam. This new proposal — it has not been signed into regulation by the president — requires further disclosure to shoppers concerning the possession and site of a enterprise. In addition, the proposal prohibits ecommerce shops from sending e mail promotions to individuals who haven’t opted in to the mailing.

Collapse of Correios Logistic Services

Correios is a state owned firm in command of Brazil’s postal providers, masking virtually all of delivering and delivery within the nation. Because Correios has authorities help, it’s harder for different logistic corporations to compete on this phase. Despite this, Correios has introduced a essential monetary drawback and doubtless might want to borrow cash this yr to honor its commitments, together with salaries of staff, orders, and provides.

Cross-border Sales

Selling to worldwide shoppers is drawing the eye of ecommerce retailers which are in search of options through the disaster. According to eMarketer, cross-border ecommerce gross sales in Brazil will develop by almost 546 % from S$P.S billion (US$838 million) in 2013 to J$sixteen.H billion (US$H.20 billion) in 2018.

PayPal commissioned The Nielson Company to conduct a research in 2014 referred to as “Modern Spice Routes: the cultural influence of Cross Border Shopping (PDF).” According to the research, shoppers from United States, China, Germany, United Kingdom and Australia spent S$B.H billion (US$465 million) with Brazilian on-line shops. Even so, retailers in Brazil don’t sometimes perceive the potential of overseas gross sales. Many will doubtless want overseas companions and suppliers to penetrate abroad markets.

Mobile Commerce

Brazilians are heavy customers of smartphones and tablets. One-hundred % of Brazilians are coated by mobile networks and ninety four % have 3G community protection. Seven % of all merchandise presently bought on the Internet in Brazil is by way of smartphones and tablets. By 2020, that proportion is projected to be 14 %.

Consumers in Brazil are more and more snug when buying by way of smartphone or pill, particularly with the rise of digital wallets. Nonetheless, Brazilian buyers are nonetheless much more possible to purchase from a desktop pc. eMarketer reported the cellular visitors proportion to ecommerce sites at 21 % and 32 % in 2014 and 2015, respectively. The desktop visitors proportion for these two years was seventy nine % (2014) and sixty eight %, once more based on eMarketer.

For probably the most half, Brazilian on-line retailers haven’t embraced cellular commerce and most don’t supply a very good buyer expertise on cellular units.

Social Media

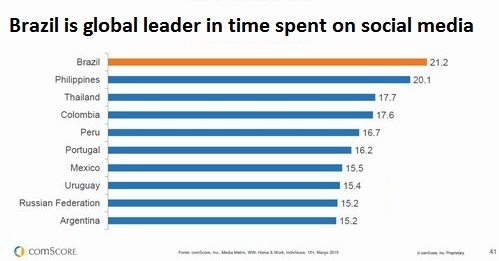

According to comScore, Brazilian consumers spent 650 hours per thirty days on social media in 2015, which is 60 % greater than the worldwide common. Facebook is the favourite in Brazil, with virtually 60 million lively customers. Moreover, Brazil leads the world in common time per go to on social media, at 21.P minutes in 2015.

Brazilians averaged 21.P minutes per session on social media in 2015. This led the world. Philippine residents have been second, at 20.B minutes per session. Source: comScore.

In brief, Brazil has a lot ecommerce potential, as does Latin America usually. Brazilian buyers are Internet savvy and the web shops there are enhancing. Many ecommerce retailers haven’t simply survived the present crises. They have thrived.