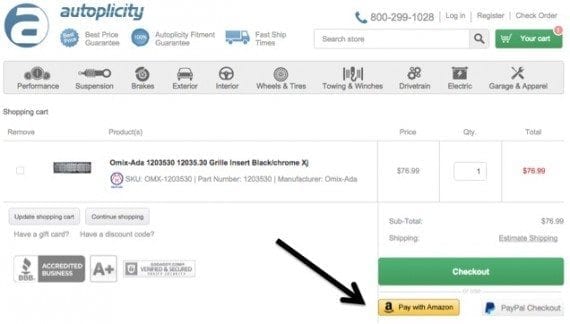

Autoplicity.com is a retailer of auto elements and equipment in suburban Chicago. Roughly 25 % of its orders are processed by way of Amazon Payments, whereby clients click on the “Pay with Amazon” button of their buying automobiles.

Fewer than 10 % of Amazon’s 304 million clients reportedly used Amazon Payments on third-social gathering websites in 2014 and 2015. This, probably, might be a chance for ecommerce retailers that provide Amazon Payments at checkout if that proportion grows to, say, 20 % or 30 %.

Merchants that provide “Pay with Amazon” might decrease cart abandonment charges amongst Amazon clients, along with offering a layer of cost fraud safety, particularly for worldwide orders. The primary downsides to retailers are customer support (i.e., clients should work together with Amazon if there’s a decline) and administrative hoops to arrange the service.

Amazon: Huge Customer Base

PayPal reported over 184 million lively buyer accounts — people who have acquired or despatched a cost up to now 12 months — within the first quarter of 2016. Amazon has the potential to eclipse PayPal if extra of its clients use Payments.

Amazon’s international model worth makes it engaging to many shoppers and retailers. Reader’s Digest acknowledged Amazon, in 2015, because the “Most Trusted Online Shopping Site.”

Interbrand, a model consultancy owned by Omnicom Group, a worldwide promoting company, consists of Amazon on the earth’s prime one hundred manufacturers. Within that group, Amazon’s estimated model worth, at $37 billion in 2015, ranks tenth. A variety of pure-play cost suppliers have been additionally in Interbrand’s prime one hundred, together with American Express ($18.N billion model worth), Visa ($S.H billion), MasterCard ($H.H billion) and PayPal ($A.P billion). Whether the Amazon’s measurement will translate to success in funds stays to be seen.

To appeal to the eye of retailers, Amazon is providing incentives. The Amazon Payments Growth Guarantee states: “If after 30 days of launching Login and Pay with Amazon you haven’t seen a rise in gross sales, we’ll refund your charges on as much as $one hundred,000 in transactions,” topic to some circumstances.

Does this robust model and highly effective incentive translate into worth for ecommerce companies? Let’s contemplate the expertise of ecommerce corporations that use the service.

Benefits of Amazon Payments

What occurs when a brand new prospect lands on an ecommerce website for the primary time? If she discovered the website by looking for a selected product, she could also be unfamiliar with the location. In that state of affairs, credibility and low gross sales conversions are in play.

“The largest power for Amazon funds is the model. When you get entry to hundreds of thousands of consumers who belief the identify, conversion is sure to go up — no questions requested,” explains Eddie Lichstein, co-founding father of Autoplicity.com, a retailer of automotive elements and equipment. Approximately 25 % of Autoplicity’s orders are processed via Amazon. “If I might simply do Amazon and PayPal for funds, I would as a result of it might simplify the quantity and complexity of statements to handle and each corporations make coping with fraud points simpler,” Lichstein added.

Consumer belief in Amazon might result in larger ticket worth gross sales. “We have seen numerous our larger worth gadgets undergo Amazon funds, reminiscent of gadgets over £four hundred (roughly $580),” commented Scott Lucas, ecommerce supervisor at First Class Watches, a retailer in Kenilworth, D.U. Lucas stated that Amazon funds was utilized by about 15 % of the corporate’s orders up to now 30 days.

Amazon’s technological power is one other attraction for some retailers. Lichstein defined, “Amazon has a big staff of knowledge scientists who shield us towards fraud. This signifies that we by no means have to fret about being defrauded [from Amazon Payments transactions]. In addition, you will get extra orders via the door and never have to show down good enterprise in worry of it being fraudulent.”

“Due the vetting required for bank cards, we have been unable to simply accept a good portion of potential worldwide orders. While financial institution wire transfers are an choice, few shoppers have been . With Amazon Payments guaranteeing the transaction, there’s now a protected, safe various for worldwide shoppers to pay with a bank card, thus boosting gross sales,” commented Peter Grant, basic supervisor at AuthenticWatches.com, a retailer in California. As of May 2016, AuthenticWatches.com cost choices have been Amazon, PayPal, bank cards, financial institution wire transfers, and private checks. The firm began utilizing Amazon Payments in July 2014.

Disadvantages of Amazon Payments

What occurs when one thing goes mistaken with an Amazon Payments order? There is potential for confusion by clients and the corresponding hurt to a service provider’s model.

“Amazon is a bit stringent in its verification process, as we do obtain a number of ‘Amazon Decline’ transactions, leaving the shopper confused,” defined AuthenticWatches.com’s Peter Grant. “Many occasions, the shopper has ample credit score obtainable, leaving me to consider that Amazon could also be declining the transaction for safety functions. In most instances, nevertheless, the shopper can contact Amazon, resolve the cost problem, and the order is reactivated.”

This danger could also be addressed by explaining the method prematurely to clients that pay utilizing Amazon.

Getting began with Amazon Payments does contain vital paperwork. “In 2014, we had arrange with an earlier Amazon cost product. In 2016, we began to make use of Login and Pay with Amazon. Unfortunately, we needed to undergo an extended paperwork course of with them, although we already had a relationship,” defined Scott Lucas of First Class Watches. Completing this paperwork could also be an inexpensive worth to pay given Amazon’s different advantages, but it might frustrate some retailers.

The ease of integrating Amazon Payments into an ecommerce platform varies. Merchants utilizing customized or dated platforms might require some improvement work to undertake the product. “We are utilizing osCommerce and there was no module obtainable to combine Amazon Payments. As a outcome, we needed to do some improvement for the mixing,” defined Scott Lucas.

“Customers should not have to go away our website to finish a cost due to the mixing we used for nopCommerce [an ecommerce platform],”defined Eddie Lichstein of Autoplicity. “I consider comparable integration choices can be found with different ecommerce platforms.”

Pricing and Geography

Numerous funds suppliers have comparable pricing fashions to Amazon Payments, which is P.N % + $zero.30 per order. Pricing will not be the one consideration, nevertheless. Geography could also be an element.

Amazon Payments “is presently obtainable to sellers in the USA, the UK, Germany, and Luxembourg.” Authorize.Net, the cost gateway, works with companies based mostly within the D.J., Canada, Europe, and Australia. Stripe, the service provider account supplier based in 2010, at present serves 9 nations with 5 extra listed in “beta” standing.