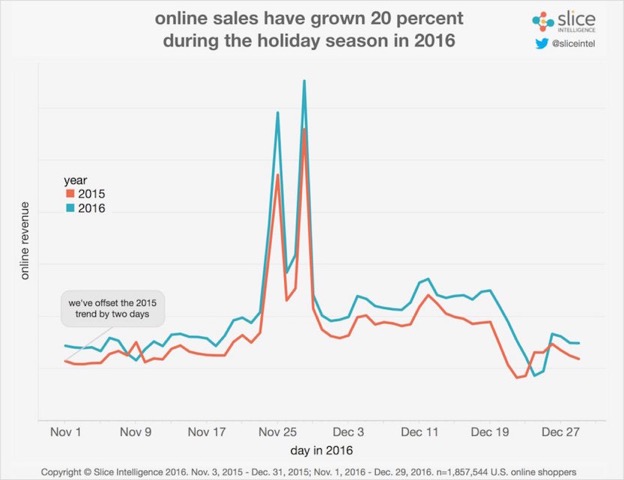

Despite considerations that political turmoil would dampen vacation spending, ecommerce gross sales made a robust displaying in 2016. Even with a sluggish November begin, revenues elevated by eleven % over 2015, in line with Adobe Digital Insights. Digital commerce measurement agency Slice Intelligence reported a extra beneficiant 20 % yr-over-yr ecommerce uptick, saying the 2 additional purchasing days in 2016 accounted for the expansion. The excellent news didn’t prolong to bodily retailer retailers, nevertheless.

Slice Intelligence reviews that on-line gross sales vacation ecommerce gross sales grew 20 % in 2016 over 2015.

Point-of-sale transaction processing agency First Data Corp’s Holiday 2016 SpendTrend report confirmed an general A.S % yr-over-yr improve in mixed on-line and brick-and-mortar shopper buying for the 2016 vacation season, up from a B.H % improve in 2015. These percentages apply to bank card transactions solely.

Robust Online Sales

Between November B and December 31 consumers spent $ninety one.S billion on-line, in accordance with Adobe Digital Insights. During that point interval, fifty seven out of sixty one days garnered over $M billion in ecommerce gross sales. Eighty-six % of the revenues got here between November B and December 20. Fifty % of website visits got here from desktop computer systems and the desktop share of gross sales was sixty nine %. Slice Intelligence reported that buyers spent forty eight % of their complete vacation spending within the month of November.

The variety of on-line transactions was up by 12 % yr-over-yr. A complete of 21.A % of all vacation spending was carried out on-line in 2016, in comparison with 15.A % in 2015, based on First Data Corp.

Mobile Activity

Fifty % of vacation website visits got here from cellular units — forty one % from smartphones and 9 % from tablets. Mobile ecommerce accounted for $28.A billion in gross sales, a 23 % improve over 2015. Smartphones contributed $19.A billion, whereas tablets drove solely $N.P billion in gross sales. Thirty-one % of complete vacation purchases got here from cellular units, principally smartphones.

Grim Prospects for Brick-and-Mortar Sector

Overall, brick-and-mortar shops noticed gross sales progress of M.S % yr-over-yr however department shops suffered a A.H % decline from 2015. Only the western states confirmed progress in bodily shops gross sales with a A.H % improve.

Macy’s, the most important division retailer chain within the D.J., reported a P.B % drop in vacation similar-retailer gross sales from 2015 and introduced over 10,000 worker layoffs and sixty eight retailer closures. Kohl’s suffered an identical P % decline. Sears Holdings Corp., which owns Sears and Kmart shops, reported a 12 % drop in similar-retailer vacation gross sales and can be closing one hundred fifty shops. At the start of 2017, ladies’s attire chain The Limited introduced that it was closing all of its 250 shops.

Retail analysts anticipate extra retailer closures, layoffs, and potential chapter filings, together with Sears Holdings Corp. in 2017.

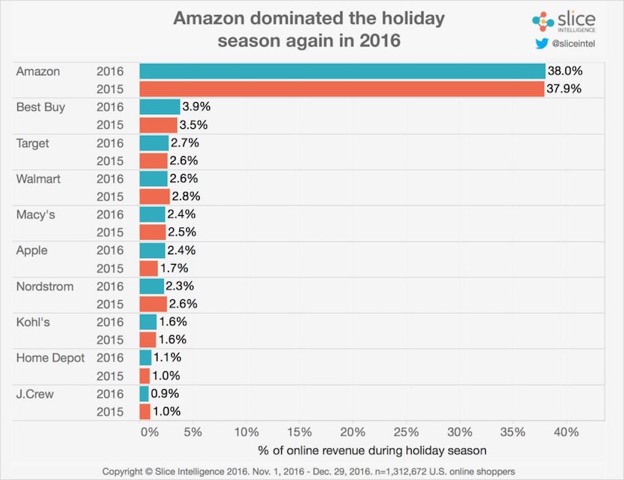

Amazon Does Well

The principal beneficiary of the brick-and-mortar slide was Amazon. According to Slice Intelligence, Amazon’s share of D.R. ecommerce gross sales grew considerably, particularly within the 10 days earlier than Christmas. From November M by way of Cyber Monday, Amazon’s share of ecommerce was 33 %, in contrast with forty four % through the last stretch —December 15 by way of December 25. This was according to Amazon’s share through the 2015 vacation season and Amazon completed the 2016 vacation with a complete share of 38 %, roughly the identical as 2015.

No multichannel retailer got here near matching Amazon’s share of complete on-line vacation gross sales.

Slice Intelligence stories that no different retailer got here near Amazon within the 2016 vacation season. Amazon acquired 38.zero % of on-line vacation income. Best Buy, at second, acquired O.N %.

The Echo and Echo Dot voice-activated synthetic-intelligence speaker units have been one of the best-promoting merchandise from Amazon this yr. Demand was so excessive, the corporate reported, that it couldn’t hold them in inventory. The greatest promoting third-celebration gadgets have been headphones from three totally different producers.

Other Amazon purchasing tidbits embrace the next.

- The variety of retailers utilizing Fulfillment by Amazon elevated by 70 % in 2016 and Amazon delivered greater than P billion packages for unbiased retailers, greater than twice what it delivered in 2015.

- Over M billion Prime and Fulfillment by Amazon gadgets have been shipped globally through the 2016 vacation season.

- Amazon Prime acquired O million new Prime subscribers within the three weeks earlier than Christmas Day.

- Over seventy two % of Amazon clients shopped on a cellular gadget, up from 70 % in 2015.

Takeaways

As brick-and-mortar shops proceed to wrestle, ecommerce vacation gross sales will doubtless present substantial good points once more in 2017. Large retail chains can survive by encouraging their clients to buy on-line however meaning they’ll probably have to shut bodily shops.

The development of shoppers purchasing for Christmas earlier within the yr will proceed with no less than half of purchases occurring earlier than December.

While cellular units will account for near half of shopper shopping for merchandise, desktops will stay robust for precise buying. Many shoppers are nonetheless reluctant to purchase by way of cellular units.